Get an insider’s look into what’s happening in and around the halls of power with expert reporting, analysis and insight from the editors and reporters of Montana Free Press. Sign up to get the free Capitolized newsletter delivered to your inbox every Thursday.

April 3, 2025

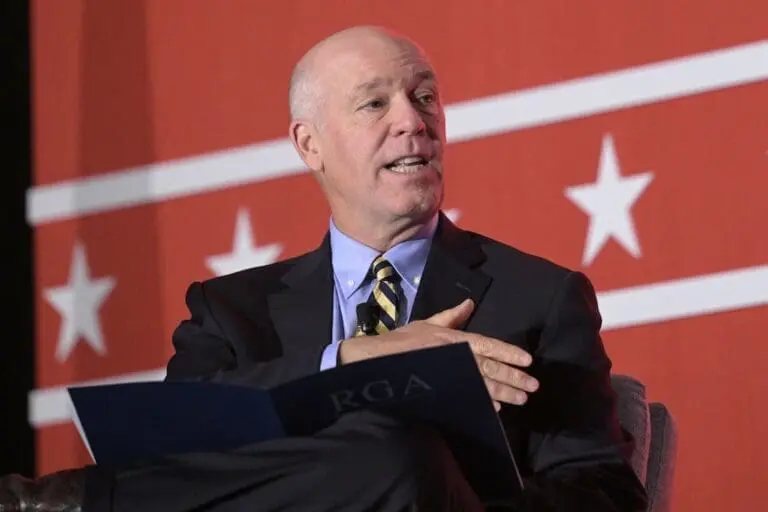

Following the state Senate’s rejection of Gov. Greg Gianforte’s signature tax policy bills, including a significant income tax cut and a property tax relief measure for homeowners, the governor remained optimistic. Addressing reporters, Gianforte emphasized the need for policies addressing Montanans’ challenges, focusing on cutting property taxes, reducing income tax rates, and enhancing education and public safety.

The governor’s proposals were part of many tax-related measures in the current legislative session, indicating ongoing negotiations over property and income tax policies. There is a possibility these proposals might resurface before the session concludes. However, the recent votes highlight bipartisan resistance to Gianforte’s plans.

Critics warn that reducing the primary income tax rate from 5.9% to 4.9% could cause a $300 million annual revenue shortfall. Both Republican and Democrat lawmakers suggest alternative tax relief plans targeting lower- and middle-income earners. Nevertheless, Gianforte advocates for a flat tax structure benefiting all income levels, arguing that other states with similar systems have achieved fairer taxation.

Gianforte supports an expanded earned income tax credit for low-income workers, asserting that economic growth can offset his proposed tax cuts. Despite acknowledging room for honest debate over tax rate reductions, the governor insists on achieving permanent property tax relief without increasing income tax burdens from the General Fund.

Lawmakers propose several property tax relief bills utilizing the state’s surplus General Fund, primarily funded by income taxes. Some suggest tax shifts from residential to other property types, while others resist tax hikes on businesses. A Gianforte-backed bill by Rep. Llew Jones, R-Conrad, aims to lower taxes on primary residences and rentals while increasing them on second homes and short-term rentals, sparing business properties.

According to Gianforte, this “homestead” approach is the fairest solution for lasting tax relief. He emphasized the necessity of enacting property tax reductions before the session’s end, ensuring they don’t compound income tax burdens.

Taking Rules to Rule the Roost

Following a lifetime floor ban and two-year committee ban on former chamber leader Jason Ellsworth, R-Hamilton, the Senate moved to fill a vacant committee seat. Sen. Josh Kassmier, R-Fort Benton, proposed appointing Sen. Gregg Hunter, R-Glasgow, to the Senate Rules Committee.

Ellsworth faced this action due to an ethics investigation over a government contract awarded to a friend without disclosure. Kassmier’s move to appoint Hunter stirred conservative objections, reflecting existing tensions on the Rules Committee.

The committee, with a bipartisan majority, handles critical issues, including a request from Sen. Shelley Vance, R-Belgrade, to investigate Senate President Matt Regier, R-Kalispell. Kassmier defended his decision, citing Hunter’s merits, while questions arose about the lack of Democrat opposition.

Watching Flowers on the Wall

Montana Attorney General Austin Knudsen, shortly after a state Supreme Court hearing on his judicial conduct violations, criticized the process as a “kangaroo court” on Missoula radio. The justices had questioned the proceedings’ timing, highlighting its proximity to an election, which Knudsen won.

Chief Justice Cory Swanson queried why only six out of 41 allegations were detailed against Knudsen. The attorney general complained about being denied the opportunity to present evidence or refute witnesses. He attributed the proceedings to his comments on court matters during a legislative subpoena battle.

The case’s outcome remains pending, with Knudsen facing possible sanctions, including a 90-day license suspension. The attorney general seeks a dismissal or mild penalty, arguing the accusations are unfair.

On Background

—

Read More Montana News