Article Summary –

The U.S. Department of Education, following the directives of President Trump’s “One Big Beautiful Bill Act,” is proposing significant changes to student aid, including redefining which fields qualify as professional degrees and implementing major modifications to student loan offerings and repayment plans. The proposed changes will cap annual loans for graduate and professional students at $20,500 and $50,000 respectively, eliminate the Grad PLUS program, and introduce a Repayment Assistance Plan to replace the existing income-driven repayment plan. Concerns have been raised, particularly from the nursing community, about the potential negative impact on access to graduate education funding, which could exacerbate the nurse shortage and affect patient care.

The U.S. Department of Education announced on Nov. 6 it completed rulemaking negotiations for significant changes to student aid, mandated by the “One Big Beautiful Bill Act.” Before finalizing, the department must draft a proposal in the Federal Register for public feedback.

While the proposed rule’s text remains unreleased, a department press release detailed changes such as redefining professional degree fields and altering student loan offerings and repayment plans. Public comments are required before any final rule is enacted.

The law directs the department to enact major student loan modifications, focusing on borrowing limits, simplifying repayment, and capping loan amounts, according to the Associated Press. The new definition lists medicine, pharmacy, law, dentistry, veterinary medicine, chiropractic, and theology as professional programs, but excludes fields like nursing and social work.

According to the eCFR Code of Federal Regulations, a professional degree signifies completion of requirements for beginning practice and a higher skill level than a bachelor’s degree.

The department aims to reduce student debt and tuition costs. “The consensus language agreed upon today will drive a sea change in higher education by holding universities accountable and reducing tuition,” Under Secretary Nicholas Kent stated.

The department also plans to end the Grad PLUS program, cap Parent PLUS Loans, and introduce the Repayment Assistance Plan, replacing the income-driven repayment plan from Biden’s administration.

Under the new plan, loans for non-professional students will be capped at $20,500 annually for graduates and $50,000 for professionals, with a $200,000 total limit, as noted by Inside Higher Ed. Previously, graduate students could borrow up to attendance cost, leading to costly programs with poor returns.

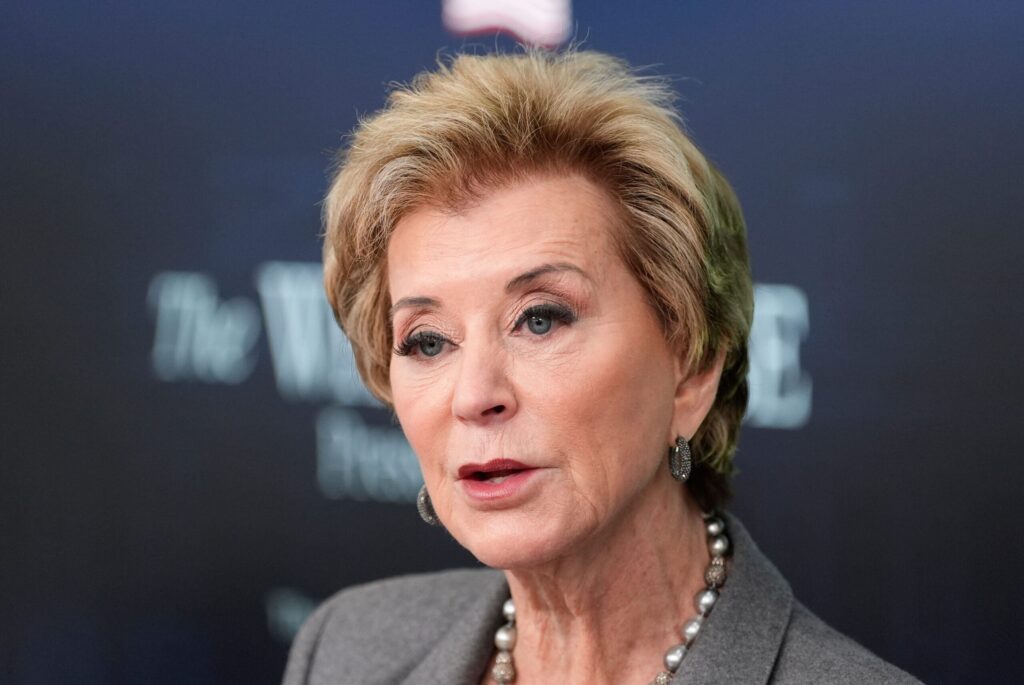

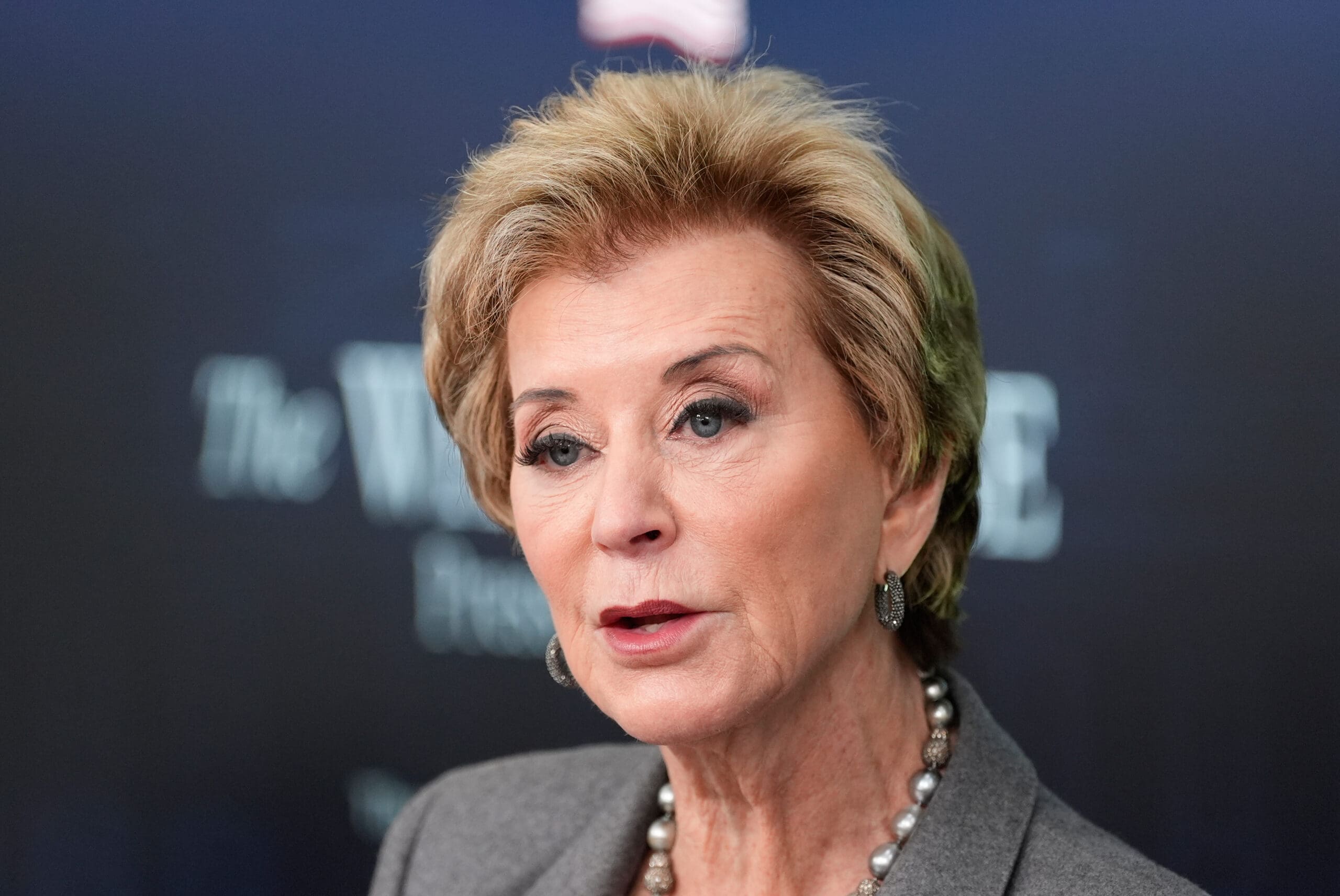

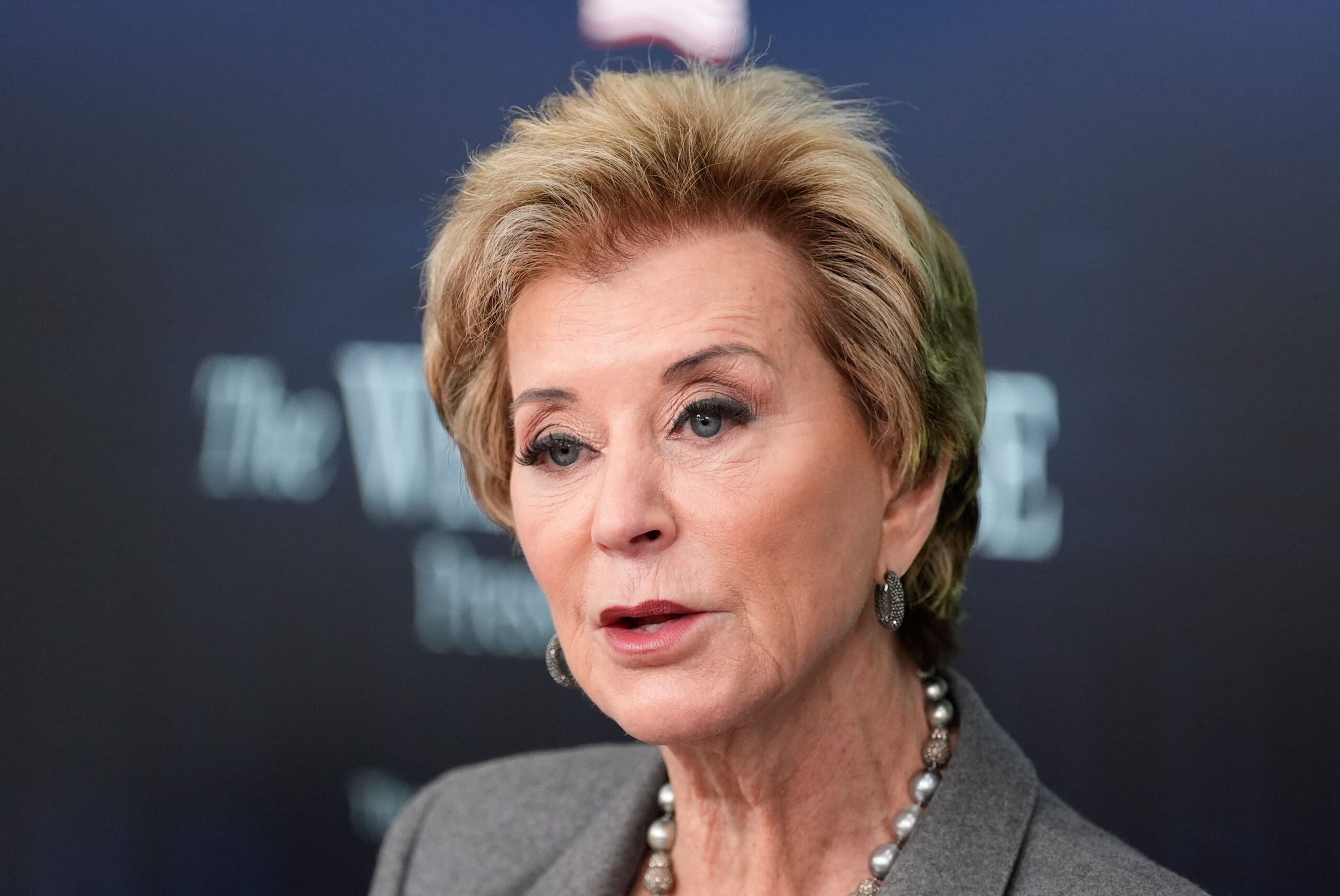

Antonia Villarruel, dean of nursing at the University of Pennsylvania, told the American Independent, “This bill will mostly impact graduate loans, affecting nurse practitioners, midwives, and other advanced nursing roles.”

In 2024, there were 267,889 students in Bachelor of Science in nursing programs, according to the American Association of the Colleges of Nursing. “Nurses are crucial to healthcare,” Jennifer Mensik Kennedy, president of the American Nurses Association, said in a statement, highlighting the threat posed by limiting access to graduate funding.

Villarruel noted that many enter graduate nursing to become primary care providers. She added, “They’re committed to long-term care and assume debt to become highly qualified professionals.”

New America reports that the Department must consider public comments for at least 30 days before finalizing the ruling.

“It’s about understanding chemistry, physiology, pharmacology, and how the body interacts within its context,” Villarruel emphasized regarding compassionate care-based practice.

—

Read More Michigan News