Article Summary –

President Trump’s administration ceased the production of penny coins as a cost-saving measure, but the lack of federal guidance has left Michigan businesses struggling with cash transactions. Businesses have varied in their responses, with some adopting practices from Canada and others incentivizing exact cash payments, while the nonbinding nature of Treasury’s guidelines raises concerns about potential legal issues, especially in light of local ordinances and federal regulations. Andrew Beardslee from the Michigan Retailers Association advocates for a federal standard to address these complexities and supports the Common Cents Act to formalize the transition, also suggesting reconsideration of the nickel coin due to its production cost inefficiencies.

The Trump administration halted penny production last year, citing cost-saving measures, leaving Michigan businesses navigating cash transactions amid unclear federal guidance on transitioning to a pennyless economy.

Andrew Beardslee of the Michigan Retailers Association mentioned to the Michigan Independent that the U.S. Mint’s decision to stop minting pennies due to their declining value was expected, given the manufacturing cost had more than doubled in a decade. The Treasury Department announced the phase-out just six months before the Mint’s final penny production on Nov. 12, 2025.

“Retailers weren’t necessarily opposed, but clear guidance on the transition is needed,” Beardslee stated. “There’s been limited clarity so far.”

The abrupt end to penny production without public guidance mirrors other parts of Trump’s economic agenda, like his tariff policies, which caused business uncertainty.

Although new pennies aren’t manufactured, around 114 billion are still in circulation. The Federal Reserve plans to recirculate them as long as possible, according to an FAQ page on the Treasury website. Consumer behavior will affect their continued circulation.

The Treasury’s FAQ, released Dec. 23, 2025, after retailers’ public outcry about guidance scarcity, advises businesses on cash transactions post-penny era. It recommends rounding prices to the nearest five cents and continuing to accept pennies as legal tender.

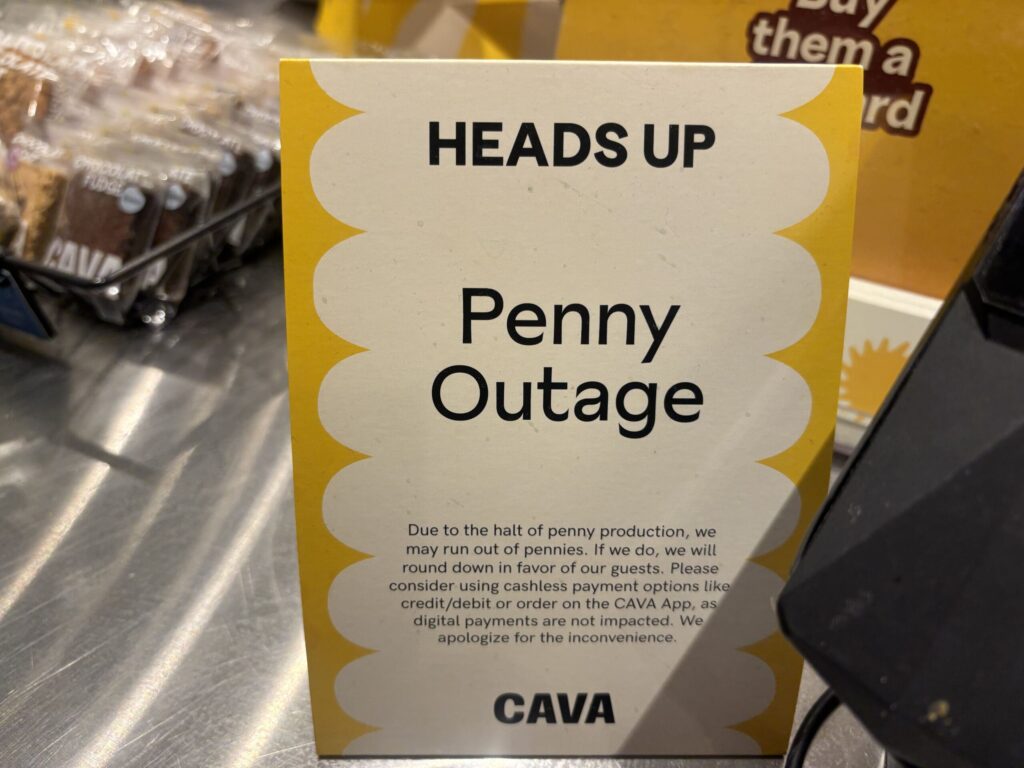

Before this guidance, some Michigan retailers independently decided their cash transaction methods: some used Canada’s model, which stopped penny production in 2012, by rounding to the nearest five cents, while others always rounded down. Kroger requested exact change from customers, and Cava encouraged cashless payments. Incentives like free coffee for exact change were also offered.

Beardslee noted the Treasury’s FAQ is nonbinding, raising concerns about its legal enforceability.

“Following FAQs doesn’t necessarily shield you from legal consequences; it’s mainly recommendations,” Beardslee explained.

Some business policies could violate regulations, like Detroit’s ordinance prohibiting cashless transactions and the USDA’s requirement to treat EBT card payments equally, which could impact rounding practices.

The Michigan Department of Treasury’s Dec. 8 memo advises rounding cash totals post-tax calculations.

Beardslee calls for federal guidance for consistency, supporting the Common Cents Act, introduced by Rep. Lisa McClain, which seeks to formalize penny production cessation and rounding practices. The bill awaits a House vote.

Beardslee speculated about discontinuing other small coins, noting a 2024 U.S. Mint report showing nickel production costs nearly triple its value.

“We might need to prepare for this with other small coins too,” Beardslee remarked.

—

Read More Michigan News