In Montana, the housing market presents a persistent challenge, with home prices outpacing the average resident’s purchasing power. Despite a slow decline in prices, experts predict no quick resolution without significant market shifts. Average home prices remain inaccessible for many, highlighting the ongoing issue of housing affordability in Montana.

During the Bureau of Business and Economic Research’s semi-annual state tour, University of Montana economists shared insights on the housing market’s future. Although there’s cautious optimism for 2026, current home prices remain unattainably high. The influx of new residents to Montana has returned to pre-pandemic levels, yet the housing costs have surged, straining residents’ budgets. Stable mortgage rates are expected to persist, leading economists to predict only modest price reductions, insufficient to resolve the affordable housing crisis.

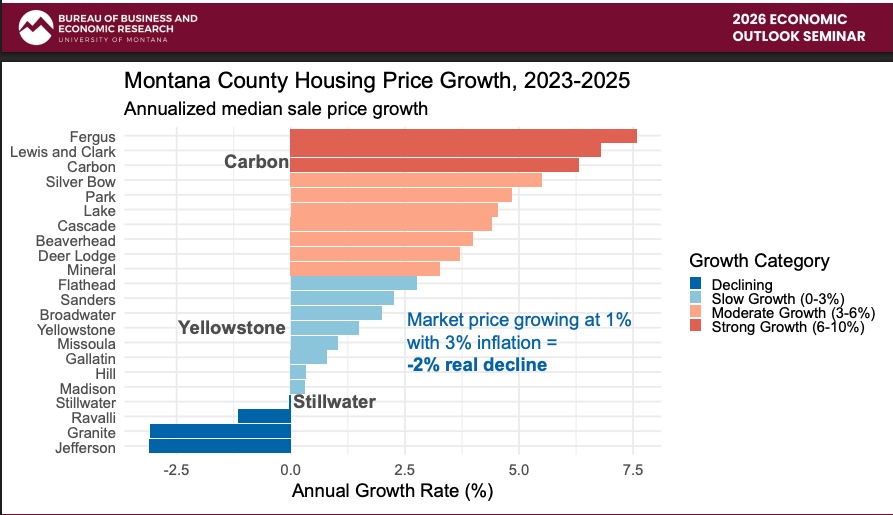

From 2017 to 2025, housing prices doubled across Montana, according to Derek Sheehan, an economist at the BBER. “The places that were growing the fastest are also showing signs of cooling,” Sheehan noted. Some counties, including Jefferson, Granite, Stillwater, and Ravalli, experienced property value increases below the average rate. A slight 1% rise in housing prices and wages has not significantly improved affordability.

In the rental market, trends mirror the housing sector, with most areas facing rising rent pressures. Gallatin County is an exception, where rental rates have decreased. In early 2025, Gallatin’s rent peaked at $2,100 monthly, while Cascade and Yellowstone counties saw rents climb to around $1,300. “One of the reasons that rent has not slowed down is because of the shift in the groups,” Sheehan explained, noting that potential homeowners remain renters, pushing up rental demand and prices.

For instance, in Yellowstone County, the largest renter group earned under $40,000 in 2021, but by 2024, incomes ranged from $40,000 to $80,000. Despite the challenges, there’s a silver lining for house hunters: Baby Boomers may eventually transition to different housing, increasing inventory. Sheehan’s three-year outlook for Montana’s housing market suggests little change, with ongoing volatility in areas like Gallatin, Missoula, and Flathead County. “There are challenges ahead, but we’re improving,” Sheehan stated.

—

Read More Montana News