Michigan Considers Property Tax Relief Amid Rising Costs

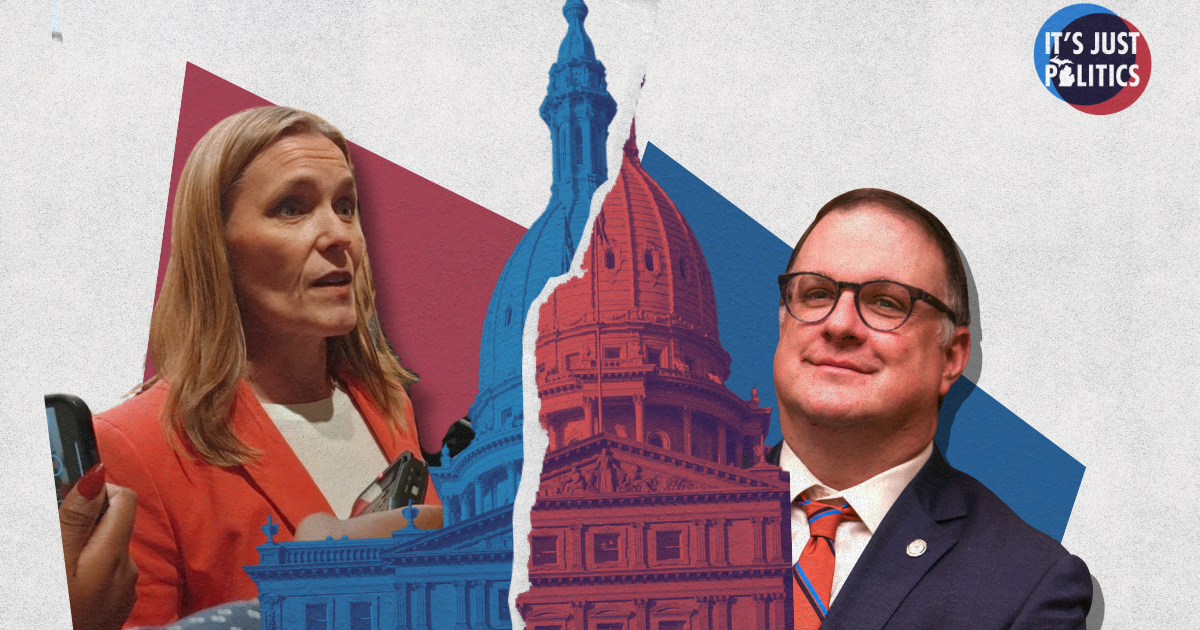

Amid growing concerns about the financial strain on homeowners, Michigan’s legislative leaders are looking into potential property tax relief initiatives. Michigan House Speaker Matt Hall has indicated that addressing the state’s property tax burden could be a priority for this fall’s legislative session.

During an appearance on “Off The Record” on Michigan Public Television, Hall (R-Richland Township) highlighted the challenges many homeowners face due to high property taxes. “We want to put something forward in the Legislature and potentially on the ballot that would help give people property tax relief,” Hall remarked in an online-only segment of the show.

The possibility of putting a property tax relief measure on the ballot is being considered, with Hall noting that a focus on this issue might commence once the state budget is finalized by the September 30 deadline. Hall stated, “Once we get through this budget on September 30, then I think our next focus is going to be how do we tackle this issue, and at that time, I’ll have a good read on whether that’s something we can pull together for this election, but we’re definitely considering it.”

Current tax limitation laws in Michigan, according to Hall, offer limited protection against tax increases when properties are sold. As housing costs continue to rise, the availability of affordable homes remains a pressing concern within the state legislature.

While Hall does not support the complete elimination of property taxes due to the potential impact on revenue for schools and local governments, there is an ongoing petition campaign advocating for such a measure. This campaign seeks to replace lost revenue with funds from other taxes.

However, discussions around property tax reforms are likely to remain on hold until the state budget is resolved. The Michigan Legislature is currently six weeks past the legal deadline for adopting a spending plan, creating uncertainty for funding in K-12 schools, higher education, and local government operations.

—

Read More Michigan News