Interest Surges Among Wealthy Foreigners for U.S. ‘Gold Card’ Residency

The allure of a “Gold Card,” an exclusive residency option for affluent individuals, is capturing the attention of wealthy foreigners eager to make the United States one of their homes. With a price tag of $5 million, this card promises a streamlined path to U.S. residency, bypassing the usual bureaucratic hurdles.

Matthew Kolken, an immigration lawyer based in Buffalo, NY, remarks, “$5 million to these people is jet fuel cost. It means nothing to them.” Kolken, who has Canadian clients interested in the Gold Card, believes the card could be undervalued given the convenience it offers.

According to immigration attorney Mona Shah, interest in the Gold Card spans several countries, with clients from India, Pakistan, Egypt, and Russia expressing curiosity. These individuals are drawn to the card’s promise of permanent residency and potential tax benefits since holders would only be taxed on U.S. earnings.

The Gold Card also carries an appeal of exclusivity, offering what President Trump referred to as “privileges – plus,” though details remain unspecified. Amidst speculation about VIP perks, Shah notes that clients envision preferential treatment, such as expedited customs processing at U.S. airports.

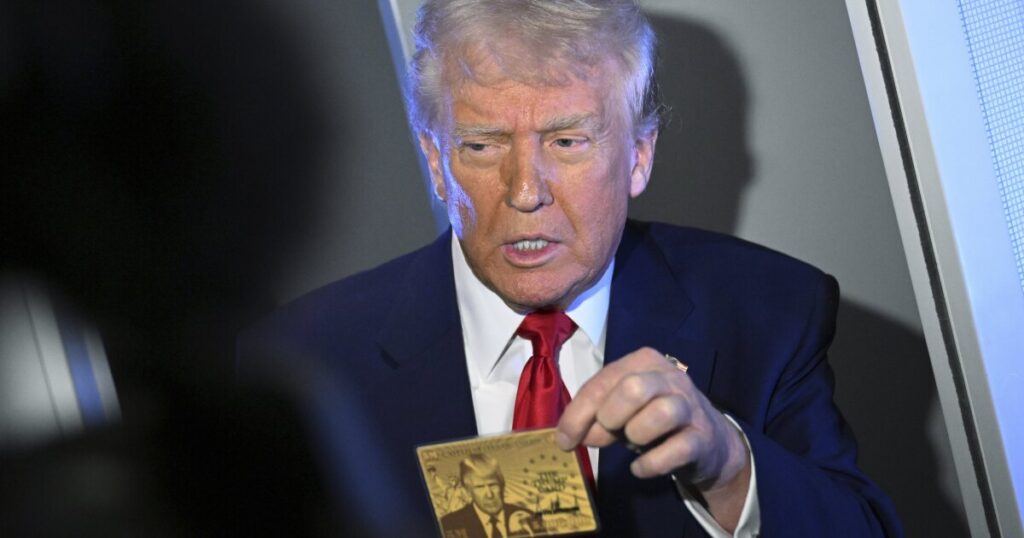

Despite the excitement, the specifics of the Gold Card, including possible benefits or conditions, remain unclear. President Trump introduced the concept in February, highlighting its potential economic impact: “Wealthy people will be coming into our country by buying this card.” Trump also mused about naming it the “Trump Gold Card,” with a government website now using the name TrumpCard.gov.

The funds generated from Gold Card sales are intended to reduce the national debt, which currently stands at $36.2 trillion. Trump optimistically projected that selling a million cards could generate $5 trillion. However, immigration experts consider such sales figures overly ambitious, expecting fewer transactions.

Immigration lawyer Darren Silver has fielded numerous inquiries but notes waning interest once potential clients learn that, unlike the EB-5 visa program, the Gold Card does not entail a business investment. Instead, it’s a straightforward $5 million payment to the U.S. government. “I had to explain to them, ‘you’re gifting the U.S. government $5 million. That’s all you’re doing,'” Silver explains, after which interest often fades.

Similar investment-for-residency programs have been tested globally, in countries like Malta and Portugal, but many have encountered challenges. Malta’s program was shut down for violating EU laws, and Spain’s was ended due to adverse effects on housing prices.

Kate Hooper from the Migration Policy Institute highlights the risk of attracting “unsavory characters” through such programs. Echoing these concerns, she states, “These programs aren’t very good at tracing who investors actually are and where their money comes from.”

Trump has assured that applicants will undergo thorough vetting, though his comments have not quelled concerns about potential applicants, including Russian oligarchs. The introduction of the Gold Card also raises ethical questions amid ongoing efforts to deport large numbers of less affluent immigrants from the U.S.

Despite the controversy, some argue the Gold Card could benefit the U.S. economy. Stephen Moore, a former Trump advisor, regards it as a preferable alternative to increasing taxes. John Lettieri of the Economic Innovation Group suggests it could enhance a merit-based immigration system.

The legal feasibility of implementing the Gold Card without congressional approval remains unclear, with some legal experts and lawmakers expressing doubts. Meanwhile, the Gold Card has become fodder for satire, with one online user humorously offering to marry wealthy foreigners for a “discounted” price of $4 million.

—

Read More Michigan News