As the November 4 election approaches, numerous schools across Michigan, from Zeeland to Novi, are requesting voter approval for bonds. These bonds, distinct from other school funding methods, are supported by local property taxes.

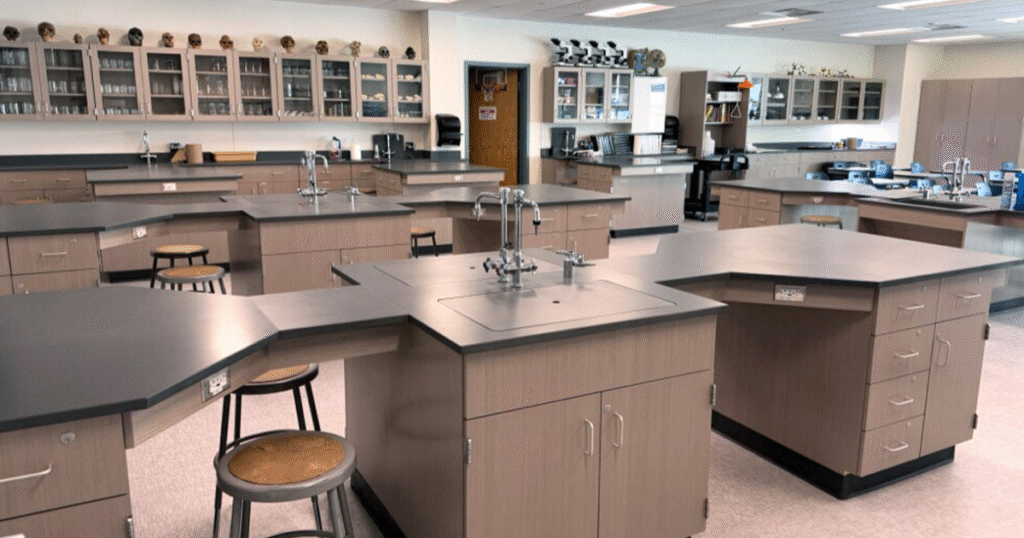

Unlike operating millages, bond millages are applicable to most homeowners, not just commercial properties and secondary residences. The funds raised cannot be used for immediate expenses like salaries and utilities but are designated for capital projects such as building new facilities or updating existing ones. This includes acquiring new security equipment, enhancing classroom technology, or purchasing school buses.

Bonds function like loans, providing immediate funds for major projects, which are then repaid over time through millages. They differ from sinking funds, which are reserved for smaller maintenance tasks, and allow communities to consider the value of proposed projects relative to the tax burden.

As David Arsen, a professor emeritus in education policy at Michigan State University, notes, bond propositions provide a platform for community discussions about district priorities. While bonds cannot fund teacher salaries or utility bills directly, they can alleviate financial pressures on operating budgets, potentially freeing funds for educational improvements. “They’re taking money that could be used to reduce class size, that could be used to increase teacher salaries,” Arsen explained. “So in those situations, passing a facility bond could help.”

Questions and answers to help you decide on school bond requests:

Click on a question to go directly to the answer.

Where can I learn about what a bond will be used for?

How can I make sure a district uses funds appropriately?

Can bonds be paid with existing taxes?

Is it a big deal when bond proposals fail?

Where can I learn about what a bond will be used for?

School districts typically provide informational resources about bond proposals, outlining project specifics, timelines, budgets, and repayment schedules. Many districts also offer visuals of areas targeted for upgrades or repairs.

“You don’t have to take hours, you know, ten minutes of searching on the website, you get a pretty good idea of what’s being planned,” said Arsen. Community engagement is encouraged through school board meetings, town halls, social media, and local news, providing citizens opportunities to discuss and influence decisions.

How can I make sure a district uses funds appropriately?

The approval of bonds involves a rigorous vetting process, including applications to the state treasurer. Schools must provide cost analyses, construction plans, and demonstrate financial capacity to repay the loan. Post-bond audits ensure compliance with the proposals, with results available on the state treasury website.

Can bonds be paid with existing taxes?

While operating millages cannot fund bonds, districts often propose renewing or extending existing millages. For instance, Novi Community Schools seek a $425 million bond without increasing tax rates, as it replaces a previous bond. This strategy is used to maintain consistent tax rates while addressing new needs.

Is it a big deal when bond or sinking fund proposals fail?

Failed bonds in Michigan prompt further community discussions to reassess needs and priorities. Watervliet Public Schools successfully adjusted their proposal based on voter feedback, whereas Mason Consolidated Schools faced challenges despite extensive community engagement. Superintendent Kelly Tuller emphasizes the need to address critical infrastructure issues to avoid disruptions despite potential setbacks.

—

Read More Michigan News