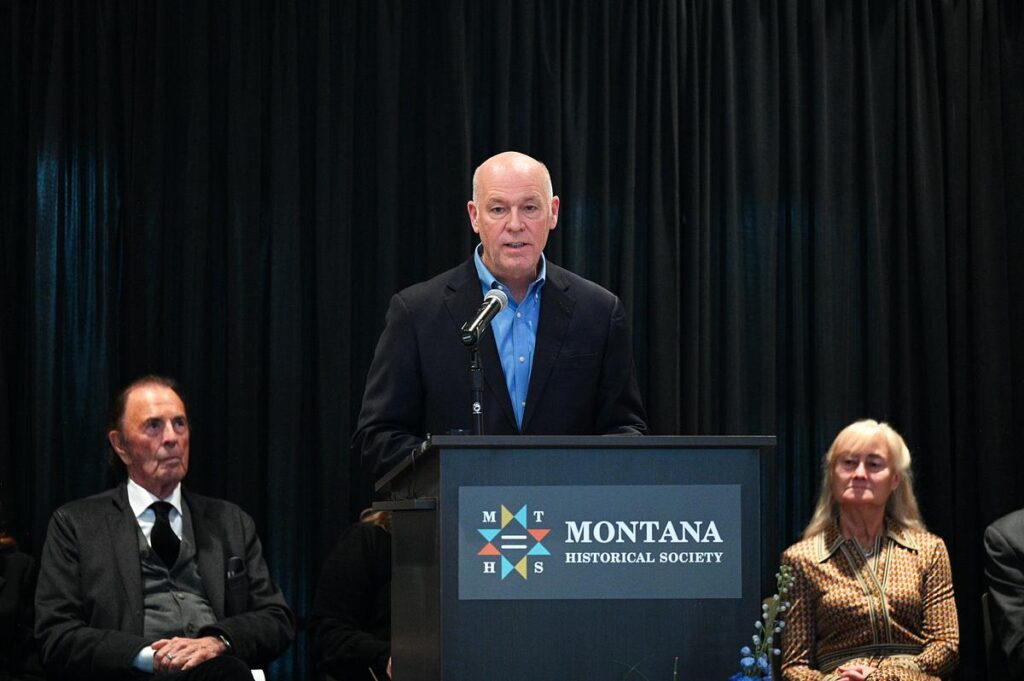

Governor Greg Gianforte has declared his Bozeman home as his principal residence for a homestead tax exemption, despite the Montana Constitution requiring the governor to reside in Helena. The homestead designation under a recently signed law mandates the property be a primary residence. A constitutional requirement states the governor must live at the government seat in Helena.

The governor’s office noted a Department of Revenue rule allows exceptions for “work assignments.” The homestead exemption, discovered via an online lookup tool, wasn’t previously reported. According to Press Secretary Kaitlin Price, “Governor Gianforte and the First Lady reside in their private Helena residence, and also spend time at their home of more than 25 years in Bozeman.”

The 1972 Montana Constitution mandates executive officials reside in Helena unless in emergencies. Gianforte’s dual residence has raised eyebrows, especially as he seeks re-election in 2024. The Montana Democratic Party accused him of ignoring constitutional residency by voting as a Gallatin County resident and claiming a tax rebate on his Bozeman home.

Past residency issues with Montana officials offer little clarity on required time in Helena. Former Secretary of State Corey Stapleton faced scrutiny for commuting from Billings, and a recent legal case voided an election over residency questions.

The homestead exemption, part of a second-home tax policy, was enacted to reduce taxes on owner-occupied and rental properties. It raises residential tax rates but grants discounts for qualifying properties. This exemption applies to homes occupied for seven months annually, and applications remain open until 2026.

Rules clarify that short absences, such as for work, do not affect principal residence status. Gianforte’s Bozeman property, valued at $1.5 million, benefits from this exemption. Without it, the home’s taxable value increases by 39%, saving about $2,600 annually.

The Gianfortes own other properties, including the historic Hauser Mansion in Helena, valued at $4 million, intended for donation to the state. They also own a fourth residence on Georgetown Lake and another home in Helena’s mansion district. None of these properties qualify for a homestead exemption, implying they will incur higher second-home tax rates next year.

—

Read More Montana News