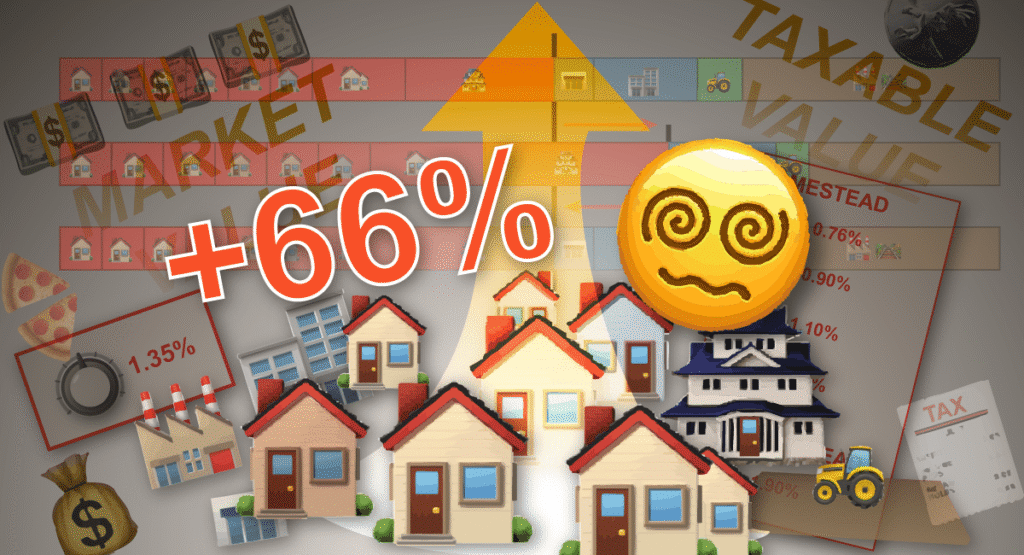

Skyrocketing home values and ensuing property tax shifts have created anxiety in Montana, prompting lawmakers to introduce a second-home tax to alleviate taxes for homeowners and long-term rental landlords. Montana’s property tax system, along with the new relief package, remains complex, leaving many Montanans puzzled about whether their tax bills will fluctuate.

MONTANA’S TAX MATH

Understanding property taxes is simpler when considering a small community. In a hypothetical town called Exampleville with various property types, tax calculations can be illustrative. The typical Montana home value skyrocketed by 66% in four years, reflecting the market trend. Taxable values, determined by the Department of Revenue, depend on state legislative rates and represent a fraction of market values subject to taxation. In Exampleville, residential properties constitute over half of the tax base, similar to the state’s 2020 scenario.

Tax bills are calculated using taxable values for statewide and local taxes, easily demonstrated with a $225,000 home, Montana’s median in 2021. With a taxable value of over $3,000 under the 1.35% rate, this property shares 4.5% of the Exampleville tax base. Voter-approved taxes often use mills, a term county treasurers utilize while preparing tax bills. The system links higher taxable values to larger shares of local services like schools and sheriff’s offices.

NUKING THE TAX BALANCE

Montana home values have surged since the pandemic, disrupting tax balance. The median home value increased by 66%, spurring higher taxes for residential property owners. Commercial and industrial properties, however, benefit from a reduced tax share as their valuations stay constant. In Exampleville, residential properties now account for 65% of the tax base, up from 53%, resulting in a 29% tax bill rise.

RATE REBALANCING WHAC-A-MOLE

Legislative discussions this year focused on adjusting taxable value rates to stabilize the tax burden across property types. By reducing the residential rate from 1.35% to 1%, property owners could see decreased taxes. However, real-world complexities like varying property values make uniform adjustments challenging. A proposed straightforward rebate would offer homeowners financial relief, yet requires substantial funding, underscoring the state’s fiscal balancing act.

HOW THE SECOND-HOME TAX ‘FIX’ WILL WORK

The new law targets second homes and luxury properties for higher taxes, while offering a “homestead” exemption for primary residences. Lawmakers aim to mitigate tax burdens for resident homeowners without excessive shifts to other property classes. Implementing the policy involves detailed rate adjustments and an interim system for 2025, with plans for a homeowner rebate. These changes will precede permanent rate tiers starting in 2026, affecting property taxes across Montana.

—

Read More Montana News