Montana’s economic outlook for 2026 appears promising, with recession risks lower than earlier projections, according to the Bureau of Business and Economic Research (BBER). At a seminar in Billings, BBER Director Jeffrey Michael highlighted Montana’s notable wage growth, elevating its national ranking from 49th to 41st over a decade. This progress aligns with Gov. Greg Gianforte’s administration goals. Additionally, Montana’s gross domestic product (GDP) and unemployment rate continue to surpass national averages.

Since 2021, Montana’s wage growth has accelerated, moving from 46th to 41st in the nation, with a growth rate of 5.4%, outpacing the U.S. average of 3.4%. Despite these gains, inflation and high housing costs have tempered some benefits, primarily affecting consumers. Job creation remains concentrated in healthcare, while other sectors experience employment declines.

Michael described the current economic climate as a “no-hire, no-fire economy,” with a predicted 2.6% growth rate for 2026. He stated, “We would say that this is a deceleration. It’s not a recession.” Inflation is expected to remain around 3% in 2026, influenced by tariffs, a point higher than it would be otherwise.

Montana is hopeful about future growth through artificial intelligence and data centers, although concerns about AI’s sustainability and environmental impact persist. Michael remarked on AI’s role in productivity growth, emphasizing its potential to enhance efficiency and output. Inflation, pegged at 2.7%, remains a concern, driven partly by tariffs. The automotive industry’s absorption of tariff costs is unsustainable, raising questions about consumer impact when these costs are passed down.

President Trump’s pressure on the Federal Reserve to lower interest rates contrasts with forecasts predicting stable rates through 2026. Housing interest rates are expected to remain flat. Montana residents anticipate significant tax cuts from the “One Big Beautiful Bill,” potentially boosting consumer spending in 2026.

Troubles Ahead

While job markets and inflation remain steady, economic headwinds like tariff uncertainty, high housing prices, and consumer sentiment could impact Montana’s 2026 economic performance. Michael noted potential economic effects from reduced immigration, leading to higher grocery prices due to fewer available workers. Hiring is concentrated in healthcare and tech sectors, with affordable housing being a persistent issue.

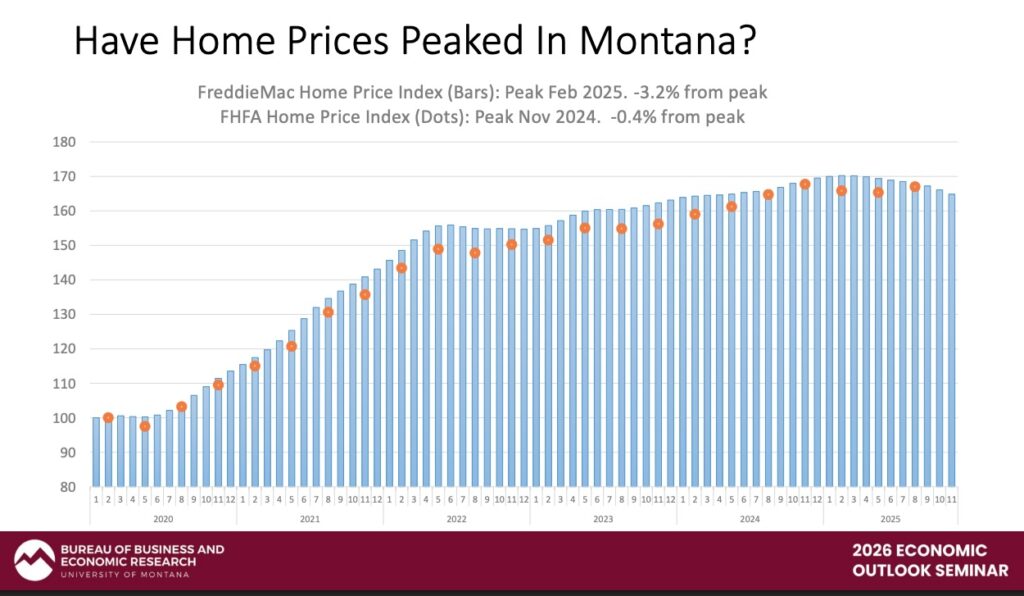

Housing prices in Montana are slightly cooling, with one index noting a 3.4% decrease since late 2024, while another indicates a 0.4% decline. Montana’s housing market remains a concern for many communities. Despite healthcare and tech sector growth, manufacturing and mining sectors experienced significant losses, with manufacturing down 2.8% and mining dropping nearly 13%, influenced by Sibanye-Stillwater mine closures amid Russian market disruptions.

Job growth was limited to four “urban” counties in 2025: Flathead (+1.8%), Gallatin (+1.5%), Yellowstone (+0.8%), and Silver Bow (+0.7%), while the rest of the state faced a 1.5% job loss, as reported by the Bureau of Labor Statistics.

—

Read More Montana News