Article Summary –

The U.S. Department of Education has concluded negotiations for major changes to student aid as outlined in President Trump’s “One Big Beautiful Bill Act,” which will redefine professional degrees, cap borrowing limits, and simplify repayment plans. The department’s changes aim to alleviate student debt by capping loans and ending programs like Grad PLUS, introducing the Repayment Assistance Plan, and potentially impacting fields such as nursing by excluding them from the professional degree category. Public commentary on these proposed changes is required before finalization, and there is concern that limiting access to graduate loans may affect the healthcare workforce amidst an existing nurse shortage.

The U.S. Department of Education stated on Nov. 6 that it finished rulemaking negotiations to implement changes to student aid as mandated by President Trump’s budget law, the “One Big Beautiful Bill Act.” A draft must be published in the Federal Register for public comment before any final changes can be implemented.

Although the proposed rule text is not yet public, changes like redefining professional degrees and altering student loan offerings are anticipated. The department must release a draft for public evaluation in the Federal Register.

The law directs major student loan reforms focusing on new borrowing limits, simplified repayment, and capped loan amounts according to the law.

Fields like medicine, pharmacy, law, and dentistry are classified as professional degree programs, reports Associated Press; however, fields such as nursing and accounting are not included.

Defined by the eCFR Code of Federal Regulations, a professional degree involves completion of academic requirements and professional licensure.

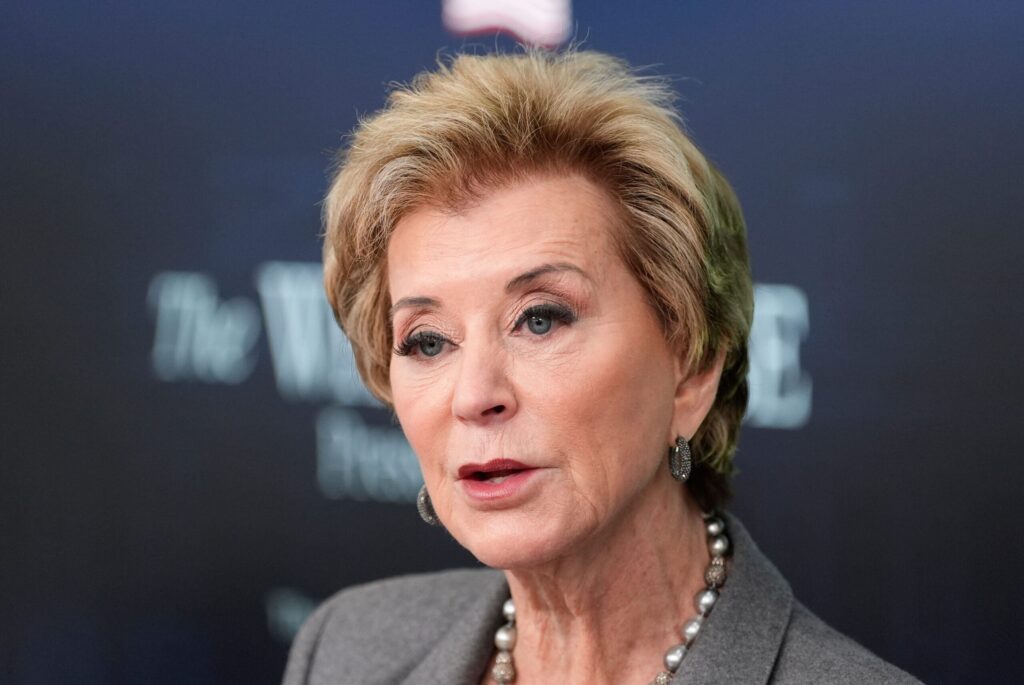

The department aims to protect student borrowers from debt and reduce tuition costs. “The consensus language agreed upon will help hold universities accountable and lower tuition costs,” said Under Secretary of Education Nicholas Kent in a press release.

Changes also include ending the Grad PLUS program, capping Parent PLUS Loans, and launching a Repayment Assistance Plan.

The new policy caps loans at $20,500 annually for non-professional graduate students and $50,000 for those in professional programs. A student in a professional program can borrow up to $200,000 over their academic career.

Previously, graduate students could borrow up to their attendance costs, leading to costly programs with low returns, states the Department of Education.

Antonia Villarruel, dean of nursing at the University of Pennsylvania, expressed concern about the bill’s impact on graduate loans, affecting fields like nurse practitioners and midwives.

In 2024, 267,889 students were enrolled in Bachelor of Science in nursing degree programs according to the American Association of the Colleges of Nursing.

“Limiting nurses’ funding access threatens patient care,” warns Jennifer Mensik Kennedy, president of the American Nurses Association, in a statement.

Nursing students take on debt to become primary care providers, says Villarruel, adding that nurse practitioners perform many tasks of a physician with comparable safety.

New America reports the Department must accept public comments for 30 days before finalizing the rule.

“The skill and education for compassionate, care-based practice require a deep understanding,” Villarruel emphasized.

—

Read More Wisconsin News