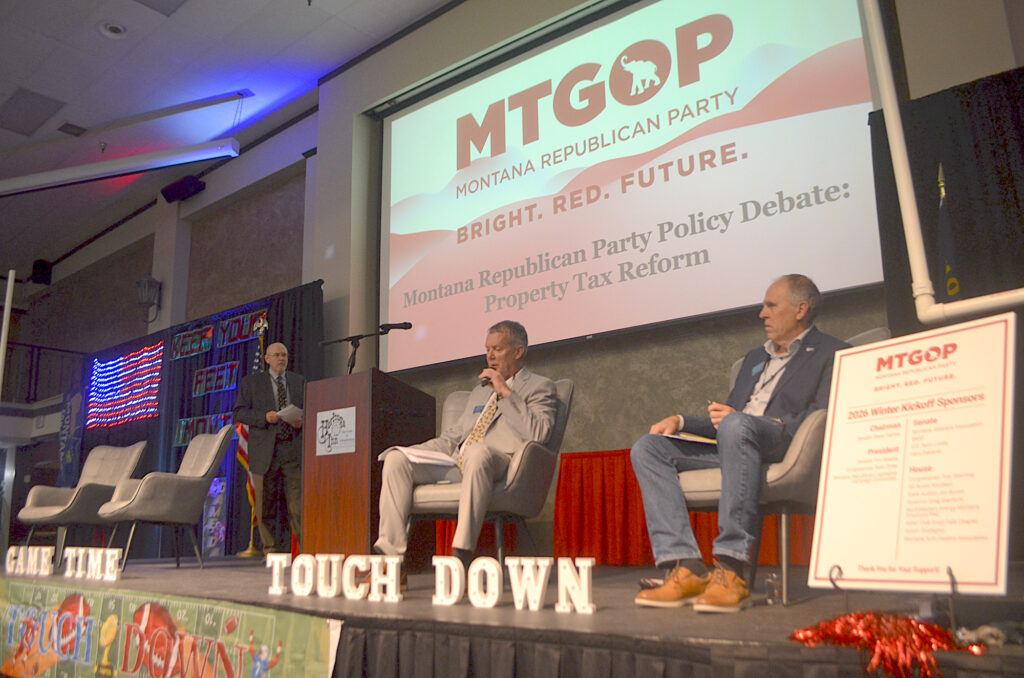

GREAT FALLS — A deep rift among Montana conservatives was on display at the Montana GOP kickoff event in Great Falls. Four chairs were set for a property tax debate, but only two were occupied. State GOP chair Art Wittich moderated as Sen. Greg Hertz from Polson and Rep. Terry Falk from Kalispell criticized the recent property tax package. The event highlighted ongoing tensions over Senate Bill 542, with Wittich noting the debate’s intensity post-session.

The empty seats were meant for supporters of the bill, who declined Wittich’s invitation. SB 542, a contentious law, includes a $90 million tax rebate, a permanent restructuring of property tax rates, and a fix to the “Billings problem” allowing the state to reimburse for tax rate reductions. Under pressure to provide property tax relief, Montana legislators passed SB 542, which has since faced criticism for rate changes and process.

With elections approaching and the 2027 Legislative session nearing, a lawsuit questions the bill’s constitutionality, with Hertz as a plaintiff. The lawsuit claims the bill was misleading, with late session changes contributing to confusion. During a debate response, Hertz criticized the rushed legislative process, stating, “You don’t even know what was in your damn bill that you voted for, and that’s the problem.”

‘You’re not welcome here’

Rep. Llew Jones criticized the debate’s fairness, noting their requirement to pay for participation. Wittich indicated a third-party moderator would have been hired if bill proponents attended. Jones said the GOP effectively excluded rural Republicans, adding, “They just booted nine folks out and effectively said, ‘You’re not welcome here.’” Sen. Josh Kassmier, one of the ousted senators, challenged the GOP to present a better plan if they have one. He suggested a special session to fix issues with SB 542, which he supported despite its amendments in committee.

Hertz and Falk offered potential fixes to SB 542, arguing it harms business owners and increases state costs. Hertz proposed altering the homestead exemption, returning to a single property tax rate, and finding new revenue sources. He also supported Republican Gov. Greg Gianforte’s flat tax rate idea, noting discussions of a potential sales tax, which would need voter approval. Hertz remarked, “If we’re going to have sales tax, we need to put in the Constitution that a percentage of it, like 80 or 90 percent of it, is used to reduce property taxes.”

‘Someone else in your tax jurisdiction’

The debate addressed the tax burden shift from one class of property tax payers to another. SB 542 aimed to cut taxes for Montana homeowners, but Hertz argued this shifted the burden to others within the same tax jurisdiction. According to the Governor’s Office, 80% of homeowners received tax cuts averaging $500, but Hertz highlighted the impact on local business owners.

Jones noted commercial property taxes rose slower than residential ones. Before SB 542, residential taxpayers bore 59% of the tax burden, compared to 38% in 1994. Jones acknowledged the challenge of balancing tax distribution, emphasizing the complexities of varying regional property values. Falk criticized the broad approach, arguing, “We are taking what is not a statewide problem and trying to apply a statewide solution.” Local government spending and energy company taxes were also debated, with consensus on the state’s economic shift from resource extraction to tourism.

—

Read More Montana News