Arizona’s recently passed state budget is facing potential challenges with the introduction of the “Big Beautiful Bill,” which could significantly impact state revenue.

According to legislative budget analysts, aligning Arizona’s tax laws with recent federal tax changes could decrease state revenue by $381 million in the current fiscal year, with additional potential impacts of $57 million.

Despite the financial implications, state lawmakers are not obliged to adapt these federal changes. The decision hinges on whether Arizona legislators, along with Governor Katie Hobbs, opt to align state tax regulations with the new federal policies.

Senate Majority Leader John Kavanagh argues against divergence, citing the simplicity of using the federally adjusted gross income as a starting point for state tax calculations. He warns of the complications that would arise if Arizona chose not to conform.

Senate Minority Leader Priya Sundareshan also acknowledges the complexity of not aligning state and federal tax laws, emphasizing the tangible burden on taxpayers.

The crucial question remains: can Arizona afford the potential revenue loss? Kavanagh, who played a significant role in crafting the state budget, believes the state can withstand the reduction, given the robust economic conditions.

However, Sundareshan contends that the state’s $17.6 billion budget is already stretched thin, and further revenue cuts might prompt Republicans to pursue deeper reductions in public programs.

Senator J.D. Mesnard, leading the Senate Finance Committee, suggests a selective approach to adopting federal tax changes, maintaining taxable income where necessary for state stability.

Among the federal changes is a notable provision allowing deductions for overtime, capped at $12,500 for individuals. This change alone could reduce Arizona’s revenue by $76.5 million if implemented.

Other federal adjustments include an additional $6,000 standard deduction for seniors and reduced taxation on tips, with potential costs to Arizona of $53.7 million and $23.6 million, respectively.

The state faces a decision on whether to adopt accelerated depreciation for business equipment, a move that could further impact revenue by over $110 million.

While the state’s Finance Advisory Committee has predicted a downturn in tax collections and rising healthcare costs, Kavanagh remains skeptical, citing improving economic conditions.

Sundareshan points to increasing tariffs and consumer prices as potential economic threats, despite recent boosts in state income tax collections due to capital gains.

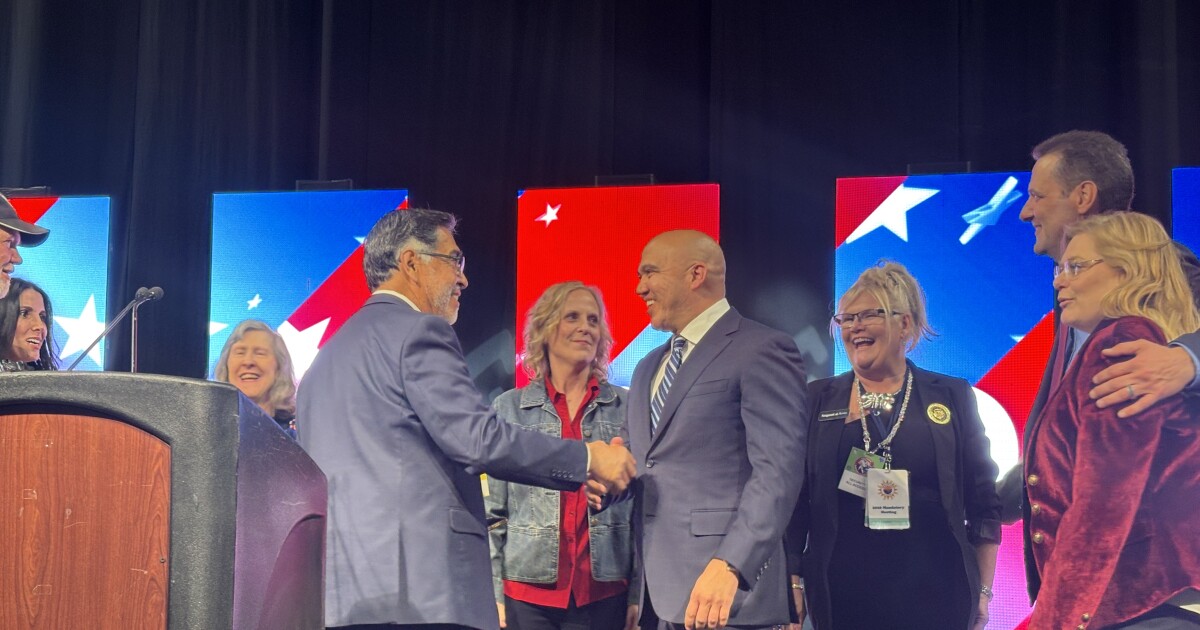

House Minority Leader Oscar De Los Santos criticizes the federal package, arguing that tax cuts for the wealthy fail to benefit the working class.

Discussions on state conformity with federal tax changes are anticipated when the Arizona Legislature reconvenes, with Governor Hobbs reviewing the legislation’s implications for state residents.

Historically, Arizona has typically aligned its tax laws with federal regulations, although deviations can occasionally benefit taxpayers, such as in the case of medical expense deductions.

—

Read More Arizona News